In the dynamic landscape of the insurance industry, automation separates the leaders from the rest of the pack. This blog delves into a real-life use case where automation digitally transforms the insurance policy management process, leading to increased efficiencies and elevated customer satisfaction.

The Challenge:

Traditional insurance policy processes often involve manual tasks, lengthy paperwork, and a high probability of errors. These challenges impede operational efficiency and hinder the overall customer experience.

The Solution: Policy Automation

Enter policy automation, which can help insurance companies streamline operations and enhance customer service. This blog tells the story of an insurance broker who successfully embraced automation to ensure accurate, efficient, and compliant data entry into third party carrier websites when customers request updates to their policies.

How One Insurance Broker Optimized Policy Modification with Automation:

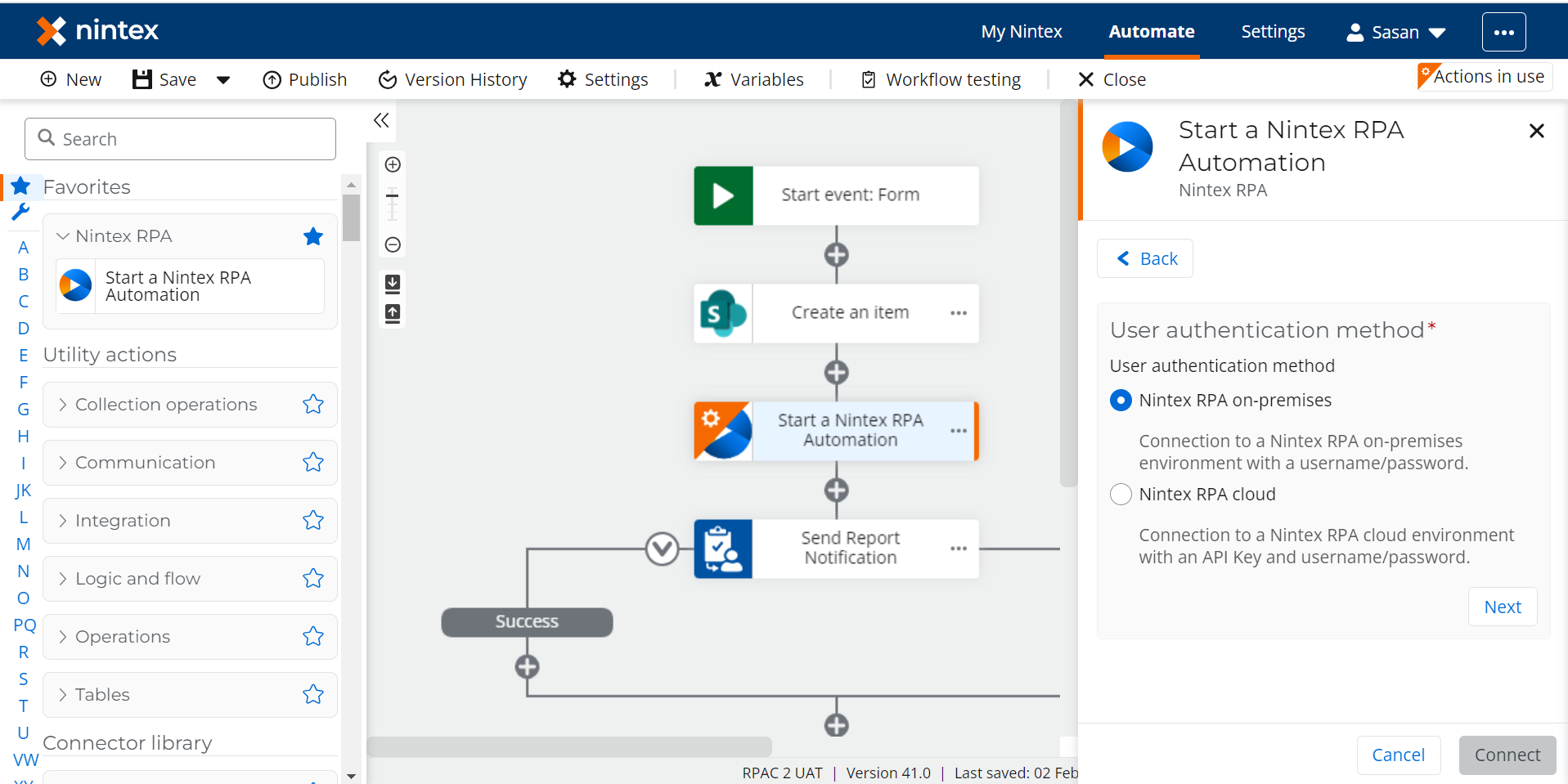

A Nintex partner, BankRPA, was able to build out a hyperautomation solution using Nintex Automation Cloud and Nintex RPA for an insurance broker. The workflow starts with a centralized form that insurance agents fill out when customers call in to make changes or modifications to their policies. Given the multitude of options for insurance carriers, BankRPA recognized the need for a solution that could seamlessly integrate these processes and provide a single workflow that could handle data coming from multiple carrier websites.

The centralized form serves as the entry point for insurance agents. Instead of navigating through multiple systems, they input all necessary information into a single form. Form submission kicks off a Nintex workflow that includes seamlessly passing data variables to Nintex RPA. This is one of the many advantages of the Nintex integrated platform, bringing together workflow and RPA botflow into a seamless end-to-end solution.

Nintex RPA, armed with the variables provided, becomes the digital assistant, navigating to the respective insurance carrier websites behind the scenes. RPA automatically performs modifications to the policies, ensuring accuracy and compliance with the carrier's guidelines. This eliminates the need for manual login and data entry into individual carrier systems and significantly reduces the risk of errors.

Post-policy modification, Nintex RPA is used to interact with the legacy Customer Information File system user interface, absent any available integrations such as APIs. The RPA automatically creates an assignment task with the variables passed, scheduling a human review of the modified policy a few days out. This not only ensures data consistency but also eliminates the need for manual intervention in initiating follow-up tasks.

Benefits Realized:

The company experienced exponential operational efficiency as dual manual data entry was replaced by a centralized, automated workflow and botflow, giving time back to agents for more important business objectives to attend to and controlling business overhead costs while serving more customers. Data entry errors disappeared, while the company remained in full compliance to insurance and government mandates.

Conclusion:

Automating the insurance policy modification process can help organizations like this one streamline a common request that is typically manual and error-prone. By eliminating data entry redundancy, reducing errors, and enhancing efficiency, insurance companies can leverage automation to streamline their operations and, ultimately, provide a superior experience for both insurers and policyholders.

This solution was built by BankRPA, a Nintex automation partner. To learn how to transform your insurance processes through automation, visit Nintex.com. To learn more about BankRPA, visit BankRPA.com.

Nintex RPA action in NAC